dependent care fsa rules 2021

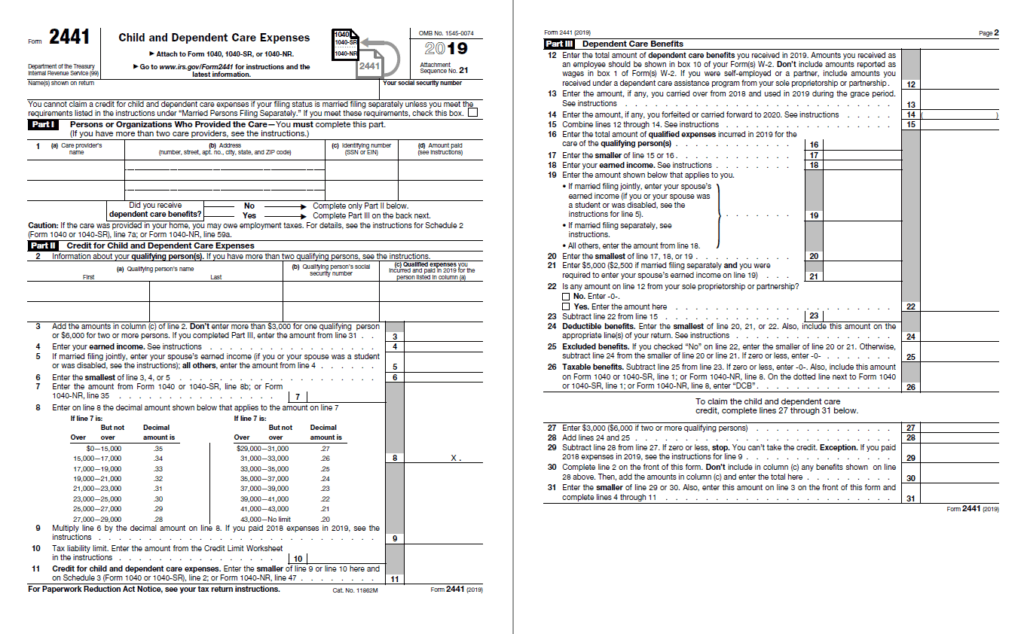

The IRS released its accompanying guidance IRS Notice 2021-26 in May. Use IRS Form W-10 to request the required information from the care provider.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money.

. In addition there is a temporary ability to carryover unused amounts for dependent care FSAs for the plan year ending June 30 2021 into the plan year beginning July 1 2021. Dependent care FSA increase to 10500 annual limit for 2021. Earlier in 2020 the IRS updated the rules to increase the maximum health FSA carryover from 500 to.

In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately. For married couples filing joint tax. The 15500 is excluded from the employees gross income and wages because 10500 is excluded as 2021 benefits and the remaining 5000 is attributable to a carryover permitted under Sec.

Dependent Care FSA Increase Guidance. Dependent Care FSA Eligible Expenses. The Taxpayer Certainty and Disaster Tax Relief Act.

ARPA Dependent Care FSA Increase Overview. If a child turned 13 in the 2020 plan year AND the participant rolled over funds into. Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March.

On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden. The TASC Dependent Care FSA allows you to use pretax dollars to pay for eligible expenses related to care for your child. The employee incurs 15500 in dependent care expenses in 2021 and is reimbursed 15500 by the DC FSA.

As more companies adopt the FSA. A Child Care Dependent Care FSA allows you to pay for certified day care pre-school and elder care needed by eligible children under age 13 or aging parents. Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars.

The money you contribute to a Dependent Care FSA is not subject to payroll taxes so you end up paying less in taxes and taking home more of your paycheck. This was part of the American Rescue Plan. The American Rescue Plan Act of 2021 gives employers the option to increase the dependent care flexible spending account DCFSA reimbursable limit to 10500 5250 for married couples filing separate tax returns for the 2021 calendar year.

Prior guidance provided flexibility to employers with cafeteria plans through the end of calendar year 2020 during which employers could permit employees to apply unused health FSA amounts and dependent care assistance program amounts to pay for or reimburse medical care or dependent care expenses. Health and dependent care FSA plans can now carryover ALL remaining balances from 2020 to 2021 and then again from 2021 to 2022. If you have a dependent care FSA pay special attention to the limit change.

The limit is expected to go back to 5000. Employers can choose whether to adopt the increase or not. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the plan year in which the child turns 13 rather than the standard IRS provision of only to the 13th birthday.

ARPA automatically sunsets the increased dependent care FSA limit at the. As the new plan year approaches please plan accordingly during open enrollment. 214 of the Taxpayer Certainty Disaster Tax Relief Act.

On January 14 2021 the Health Service Board approved the following three changes to Child. ARPA increased the dependent care FSA limit for calendar year 2021 to 10500. A plan that includes a health FSA may allow similar to the rules applicable to DCFSA an employee who ceases participation in the plan during calendar year 2020 or 2021 for example due to termination of employment to continue to receive reimbursements from unused benefits or contributions for expenses incurred through the end of the plan.

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. If you have a stay-at-home parent in your household you are not eligible for a Child Care Dependent Care FSA. The CAA extends the maximum age limit for dependents to be eligible for dependent care FSA.

Typically if you dont spend your Dependent Care FSA funds by the end of the year you lose that money. Health and Dependent Care FSA Carryover. ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only.

With a Dependent Care FSA you use pre-tax dollars to pay qualified out-of-pocket dependent care expenses. In 2021 the dependent care fsa limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately. 2021-R-0054 February 11 2021 Page 4 of 4 employers offering health and dependent care FSAs to adopt temporary rules to provide employees more flexibility in using their benefits and prevent them from losing their unused funds PL.

Employers can choose whether to adopt the increase or not. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022. Double check your employers policies.

As with the standard rules the limit is reduced to half of that amount 5250 for married individuals filing separately. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Dependent Care Account American Fidelity

How A Dependent Care Fsa Can Enhance Your Benefits Package

Child And Dependent Care Expenses Credit Youtube

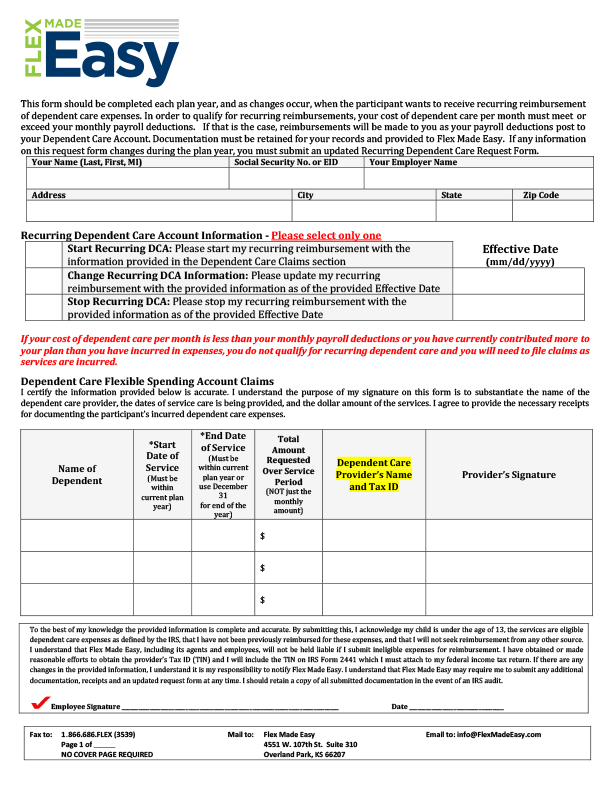

Dependent Care Flexible Spending Accounts Flex Made Easy

2021 Changes To Dependent Care Fsas And What To Know

What Is A Dependent Care Fsa Wex Inc

Dependent Care Flexible Spending Accounts Flex Made Easy

What Is A Dependent Care Fsa Wex Inc

What Options Are Available In A Dependent Care Flexible Spending Account Now Tri Ad

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Changes To Dcfsa Cdctc White Coat Investor

2021 Irs Rules Allow For One Time Changes To Child Care Dependent Care Fsas San Francisco Health Service System

Dependent Care Fsa Dcfsa Optum Financial

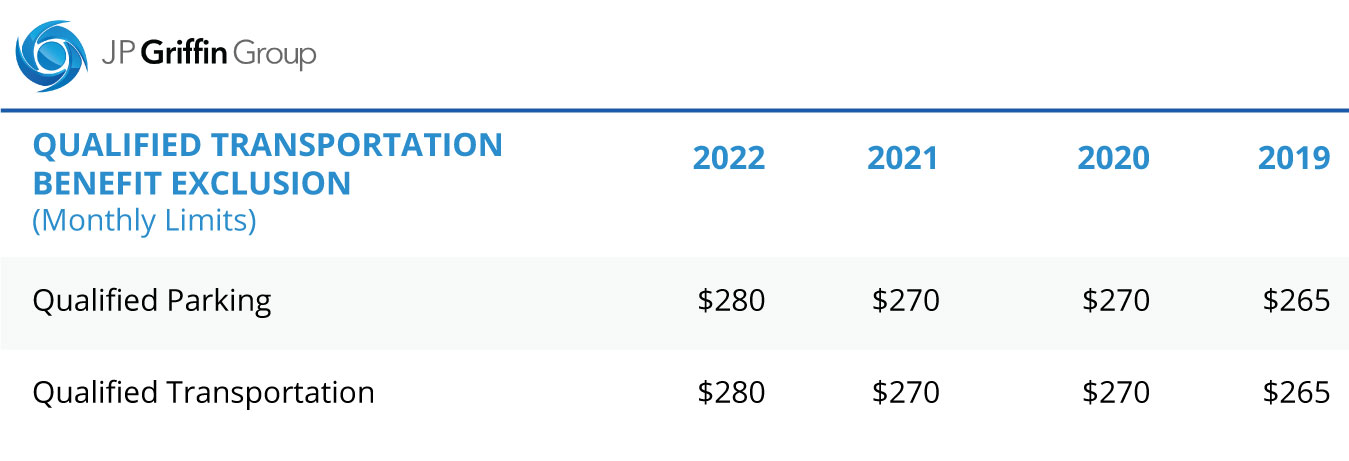

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

How The American Rescue Plan Act Of 2021 Impacts Dependent Care Assistance Programs Word On Benefits

Dependent Care Benefits Overview Criteria Types

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning